In today’s fast-paced world, it is crucial for businesses to regularly assess their financial health. Just like individuals need to monitor their physical well-being, businesses need to conduct checkups to ensure their financials are on the right track. This article will guide you through a comprehensive financial health checkup for your business, highlighting key areas to focus on and strategies to maintain a stable financial foundation.

1. Assessing Revenue and Profitability

The first step in conducting a financial health checkup is to evaluate your business’s revenue and profitability. Examine your financial statements, such as income statements and balance sheets, to identify trends and patterns. Look for fluctuations in revenue, margins, and net income over time. This analysis can help you understand if your business is generating consistent profits and if any adjustments need to be made.

2. Managing Cash Flow

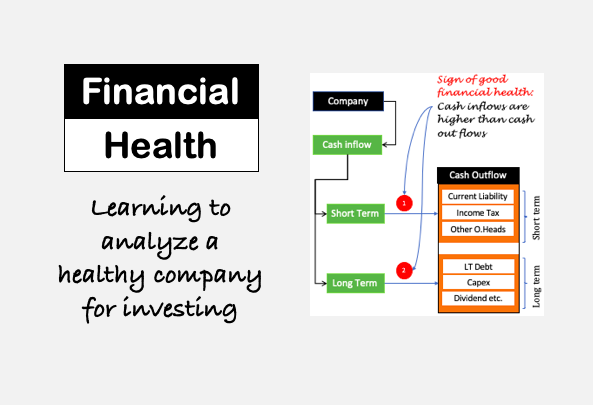

Cash flow is the lifeblood of any business. Without proper management, even profitable businesses can face financial hardships. Review your cash flow statement to identify any potential bottlenecks or areas of concern. Ensure that your inflows and outflows are aligned and that you have sufficient cash reserves to cover short-term expenses and emergencies. Consider implementing effective cash flow management tools and strategies to improve liquidity and manage working capital efficiently.

3. Analyzing Expenses

Examining your business’s expenses is vital to maintain financial health. Categorize your expenses into fixed and variable costs. Assess if any costs have been escalating and if there are areas to optimize spending. Look for opportunities to negotiate with suppliers, explore cost-effective alternatives, or streamline your operations to reduce overheads. Alignment between expenditures and revenue growth is crucial for sustainable financial health.

4. Reviewing Debt and Credit

Debt can either be a helpful tool or a burden on your business’s financial health. Evaluate your outstanding debt, including loans, credit lines, and credit card balances. Consider the interest rates, repayment terms, and any associated fees. Ensure that your debt is manageable and reasonable, keeping in mind your business’s revenue and cash flow. Regularly reviewing and restructuring debt can help improve your financial standing and creditworthiness.

5. Monitoring Key Financial Ratios

Utilize key financial ratios to gain insights into your business’s financial health. Ratios such as liquidity ratios, profitability ratios, and debt-to-equity ratios provide valuable information about your business’s financial performance. Compare these ratios with industry benchmarks to identify areas of strength and weakness. Monitoring these ratios regularly can help you make informed decisions and take appropriate actions to maintain a healthy financial position.

6. Planning for the Future

Having a clear financial plan is crucial for the long-term success of your business. Define your short-term and long-term financial goals and develop strategies to achieve them. Set realistic targets for revenue growth, cost reduction, and profitability. Establish a budget and regularly track your actual performance against the planned targets. Adjust your strategies and plans as needed to stay on track and adapt to changing business environments.

By implementing these strategies, regularly conducting financial health checkups, and staying proactive, your business can build a solid financial foundation and weather any economic storms. Remember, seeking professional advice from accountants or financial advisors can provide additional insights and expertise tailored to your specific business needs.

Maintaining financial health should be an ongoing process rather than a one-time event. Make it a priority to regularly review and assess your business’s financial well-being. By doing so, you can ensure that your business stays resilient, adaptable, and on the path to long-term success.