Investing wisely” width=”474″ height=”263″>

As a business owner in the tech industry, it is crucial not only to focus on the growth and success of your business but also on building personal wealth. This article will provide valuable insights and strategies to help you achieve and sustain financial prosperity.

1. Separate Personal and Business Finances

One of the first steps to building wealth is to establish clear boundaries between your personal and business finances. This separation ensures better financial management and allows you to track and analyze your personal wealth-building progress accurately.

2. Create a Solid Financial Plan

A well-designed financial plan is essential for any business owner seeking to build wealth. Consult with a financial advisor to gain insights into investment opportunities, tax strategies, retirement planning, and other relevant aspects to ensure that your financial plan aligns with your long-term goals.

3. Diversify Your Investments

Investing wisely is key to wealth building. While your business may be your primary asset, it is essential to diversify your investments to reduce risk. Explore opportunities in stocks, real estate, mutual funds, or other promising ventures that align with your risk tolerance and financial goals.

4. Leverage Technology for Efficiency

In the rapidly evolving tech industry, leveraging cutting-edge technology can significantly enhance the efficiency and productivity of your business operations. Adopting innovative tools and software solutions can help reduce costs, streamline processes, and free up time and resources for wealth-building strategies.

5. Continuously Educate Yourself

As a tech entrepreneur, staying updated with the latest trends, opportunities, and market insights is crucial. Engage in continuous learning by attending conferences, industry webinars, and seminars to gain valuable knowledge that can positively impact your business growth and wealth-building efforts.

6. Network and Form Strategic Partnerships

Building meaningful professional connections and strategic partnerships can open doors to new opportunities for growth and wealth accumulation. Attend industry events, join relevant associations, and actively network with like-minded individuals to expand your business network and unlock potential collaborations and investments.

7. Prioritize Saving and Investing

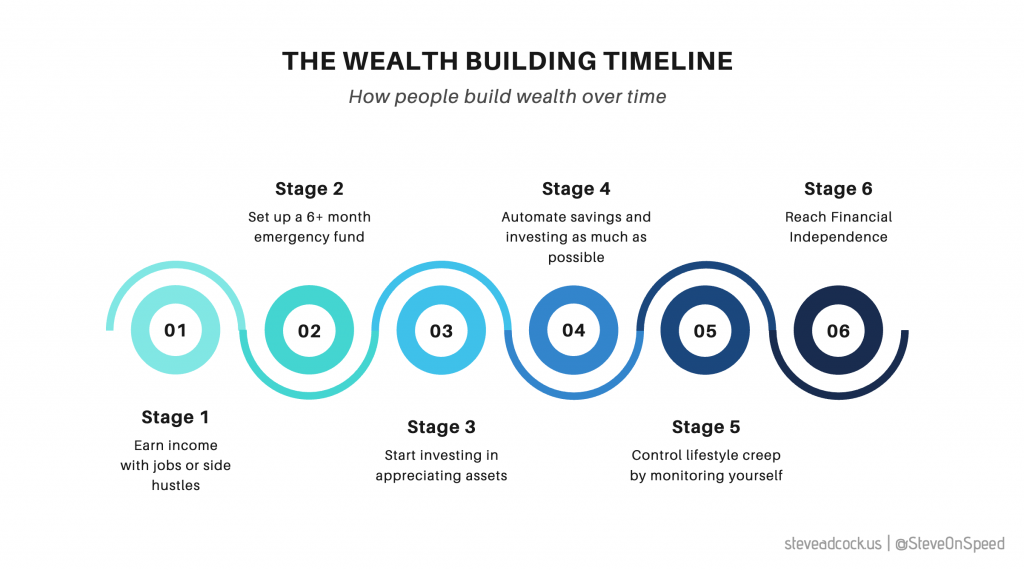

Make it a habit to set aside a portion of your earnings for savings and investments. Building an emergency fund provides a safety net during challenging times, while consistent investments in diverse assets increase the potential for long-term wealth growth. Automating these processes can help you stay disciplined and ensure regular contributions.

8. Seek Professional Guidance

Building wealth requires knowledge, expertise, and time. Consider hiring financial professionals who specialize in wealth management and investment planning to guide you on the most effective strategies tailored to your specific situation and goals.

Conclusion

Building personal wealth as a business owner in the tech niche goes beyond the success of your company. It requires a well-structured financial plan, diversification of investments, leveraging technology for efficiency, continuous learning, networking, disciplined saving and investing, and seeking professional guidance. By implementing these strategies, you can pave the way for long-term financial prosperity, ensuring a secure future for yourself and your loved ones.